Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

September 12, 2017 |

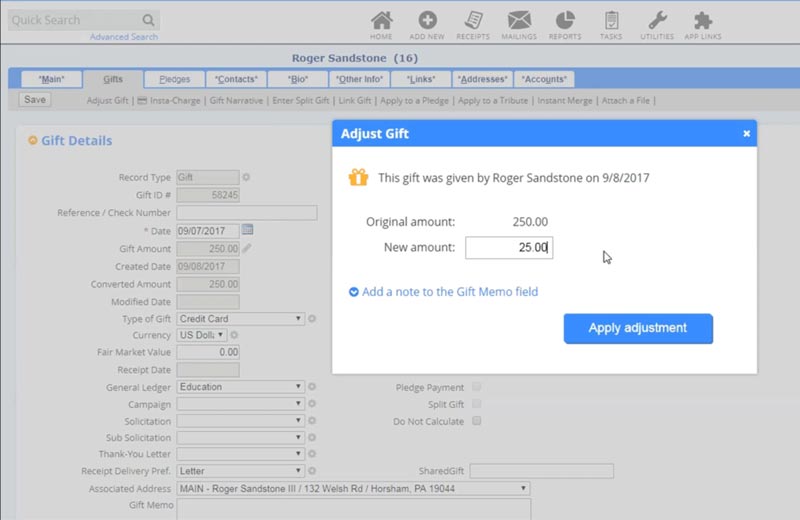

Have you ever had a donor ask for some or all of their money back because they are no longer able to attend an event? Or maybe you’ve entered a credit card gift in DonorPerfect, and then realized you put in the wrong amount? The process to issue a refund or void for your adjusted gifts used to involve making changes in several places with no easy way to track your changes for reconciliation.

You asked us for a better way and it’s coming! Over the next month or so, we’ll be rolling out our Adjustments feature that will streamline your refund/void process. You’ll never need to leave DonorPerfect again to refund or void credit card and echeck transactions. (WOOT!) Even better, this new process creates an audit trail of any gift amount changes, which makes reconciling DonorPerfect with the Gateway and other financial systems a breeze.

Once you enter a gift, the gift amount field becomes read-only. Follow these steps if you need to adjust a gift after entering and saving it.

To track adjusted gifts, run the Adjusted Gifts Report in the Financial Reports folder in Report Center. The Adjusted Gifts Report provides an audit trail to track changes to adjusted or voided transactions including the date, type of gift, General Ledger code and donor name.

Follow us on social!