Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

February 28, 2018 |

How do you balance the need to support your donor engagement efforts with the need to track funds and reconcile bank deposits? It’s a scenario that just about every nonprofit faces – the dreaded double data entry. You track gifts, pledges, contacts and other important constituent information in DonorPerfect. This is vital for maintaining a good relationship with your donors. But, your accountant wants you to track gifts and other funds in nonprofit accounting software like QuickBooks. You don’t have time to enter data twice! How do you choose? The good news is you don’t have to. Now you can post gifts from DonorPerfect to QuickBooks Online seamlessly.

For months now, participants in our successful QuickBooks Beta program have maintained their donor information and history in DonorPerfect while posting gifts from DonorPerfect to QuickBooks Online. In fact, clients that participated in our QuickBooks Beta Test program have posted over 83,000 DonorPerfect gifts for $41 million to QuickBooks. Following this weekend’s release of DonorPerfect, you can access our new QuickBooks integration, via the AppLinks menu. You don’t have to waste another minute doing double data entry.

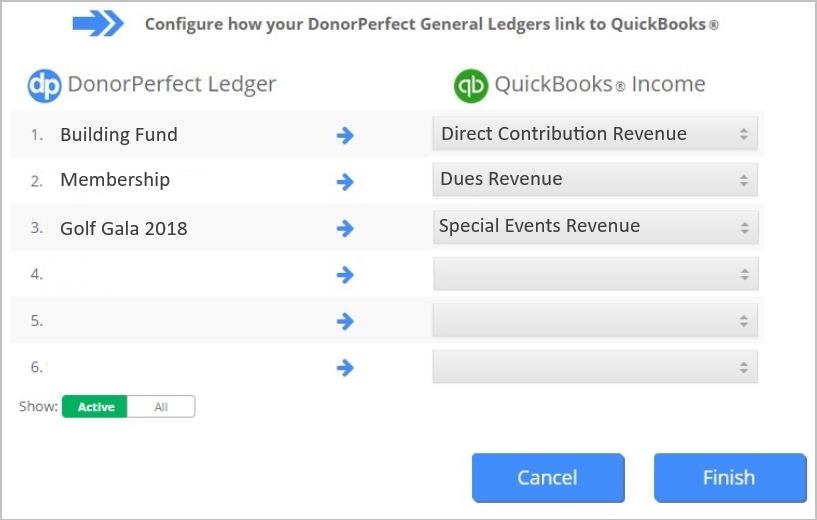

Before you can post gifts from DonorPerfect to QuickBooks Online, you need to set it up. It’s a quick five step process that we guide you through on screen. In DonorPerfect, go to App Links > QuickBooks and click Connect to QuickBooks. Once you enter your Intuit Account information, you’ll be prompted to select your bank account, choose a post method, sync your donors, map general ledgers and map classes. That’s it! If you need to add additional items later, simply go to the Settings tab inside DonorPerfect’s QuickBooks interface.

Visit QuickBooks Online Overview for full procedures on setting up QuickBooks Online in DonorPerfect.

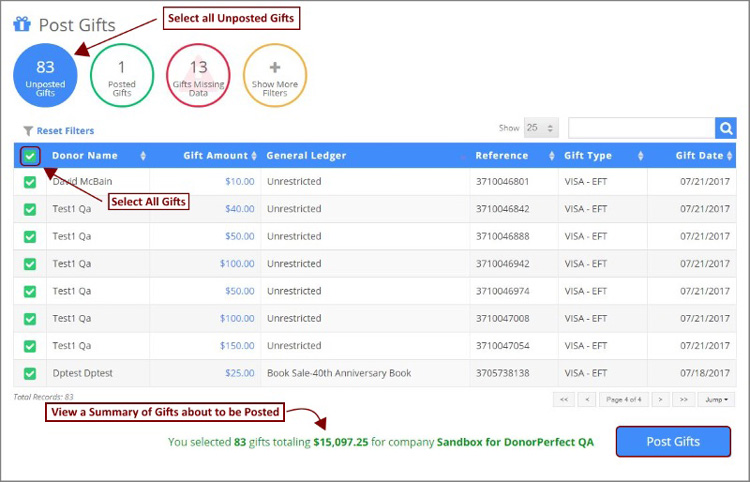

We’ve made it easy to post gifts from DonorPerfect to QuickBooks Online. You never need to leave DonorPerfect to do it. During the setup process described above, you linked DonorPerfect donors and gifts to QuickBooks customers, classes, bank accounts, and income accounts. Once that’s done, clicking QuickBooks from App Links, takes you directly to the Post Gifts tab.

1. To post gifts, go to App Links > QuickBooks.

2. The first icon notifies you about Unposted Gifts based on the default date range of the last 90 days.

3. Click Show More Filters to adjust the date range and add additional filters. You can add any existing DonorPerfect Selection Filter (e.g., Gift amount greater than $100 in Pennsylvania) or create a new one.

4. In Unposted Gifts, either select individual gifts manually or choose the checkbox in the header to select all gifts.

5. Gifts with missing data won’t be included in Unposted Gifts. You’ll need to fix the missing data first.

6. Click Post Gifts.

Visit Posting Data to QuickBooks Online to learn more about how to post gifts from DonorPerfect to QuickBooks.

Explore all the features of DonorPerfect’s QuickBooks Integration demonstrated on a live system in a FREE webinar on Thursday, 3/8 at 1PM ET. You’ll have a chance to submit your questions.

The ability to post DonorPerfect gifts to QuickBooks Online isn’t the only improvement in this release. Read about all of the enhancements and fixes in the DonorPerfect 2018.02 Release Notes in the Knowledgebase in DP Community.

Follow us on social!