Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

September 27, 2019 |

While the convenience of accepting credit cards empowers your organization to offer customers easy and flexible ways to pay, understanding your merchant account statements and what you’re really paying to process credit cards can be anything but easy!

Many merchant accounts and processing statements have a variety of rates and fees that are hard to decipher. The truth is, the complexity is often intended to be confusing and to hide what your actual costs really are.

Most people focus on the base rate or percentage, but the credit card processing fees don’t stop at your processing rate. There are often surcharges, monthly fees and assessments that can raise your true cost substantially.

The best way for you and your organization to measure your real processing cost is to calculate your effective rate. The effective rate is simply the total of all costs divided by the volume of payments processed.

Fortunately, calculating your effective rate is actually pretty easy. Here’s how to do it in 3 simple steps.

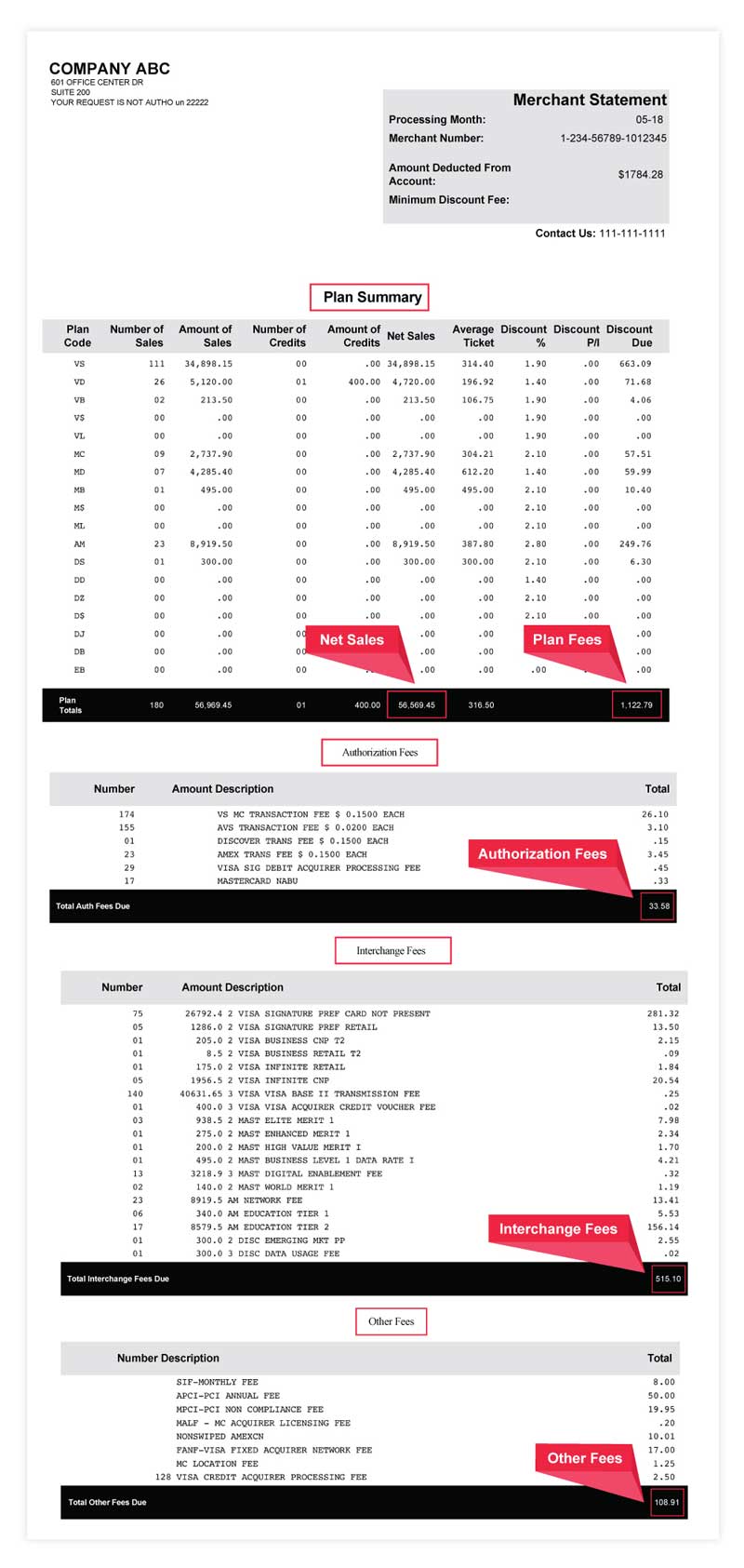

In many cases, identifying all of the fees to include can be challenging because they may be listed in different places on your statement. Some common fees to look for are:

Next, we need the total amount of transactions (sales). We suggest using net sales which reflects the volume after any refunds issued. Add up all of the sales you generate within a given month. Note in this example Amex transactions are included in the processing volume and costs, but you should exclude Amex volume if you pay a separate set of Amex fees.

Now that you’ve calculated your total fees and sales, you’re ready to plug them into the effective rate formula:

Not Sure You’re Calculating This Right?

We’re happy to do it for you — just send two months statements to donorperfect@safesavepayments.com and we’ll send you a free report on your effective rate!

At DonorPerfect Payment Services, we think it’s important for you to know exactly what you’re paying for processing, which is why our integrated credit card processing service uses simple fixed rates that are easy to understand and compare.

We’re happy to help you correctly calculate your current processing costs from the provider you’re using today and provide you with a free, no obligation rate comparison so you can make the best decision for your business. To get started, send statements from your last two months of processing to donorperfect@safesavepayments.com or give us a call at 800.220.8611.

Follow us on social!