Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

January 25, 2021 |

Growing in popularity, donor-advised funds are a vehicle for change that invite nonprofit organizations to establish relationships with funders who can meaningfully contribute to the success of their growth. While it may seem like a no-brainer, many nonprofits pass on pursuing grants from donor-advised funds. But that’s probably because they don’t know that:

To acquire grants from donor-advised funds for your nonprofit, it’s important to know how they work and how to effectively manage relationships with these major donors. Let’s walk through the basics of donor-advised funds so your team can begin to work this specific type of solicitation into your fundraising strategy.

Download our free guideA donor-advised fund is a philanthropic giving vehicle administered by a charitable sponsor. A charitable sponsor is a 501(c)(3) organization that has legal control over the donor-advised fund and is responsible for operating and maintaining it. Charitable sponsors include public charities, community foundations, and charitable funds that are associated with an investment firm.

Donors contribute to a fund held by a charitable sponsor and receive an immediate tax benefit. Over time, donors recommend grants from the fund to their favorite charities. The charitable sponsor awards grants to nonprofits recommended by donors. Note that in addition to cash, donors can also contribute appreciated assets such as stocks, real estate, etc., which can provide substantial tax savings for the donor.

Donor-advised funds are typically invested in mutual funds or other investment vehicles that allow the value of the funds to grow over time, increasing the donor’s ultimate philanthropic impact.

While donor-advised funds are increasingly common, many nonprofit organizations have not had to manage the intricacies that arise when receiving gifts from these entities. We’ve put together a useful list of details to keep in mind about donor-advised funds and how they will impact your record-keeping and operations.

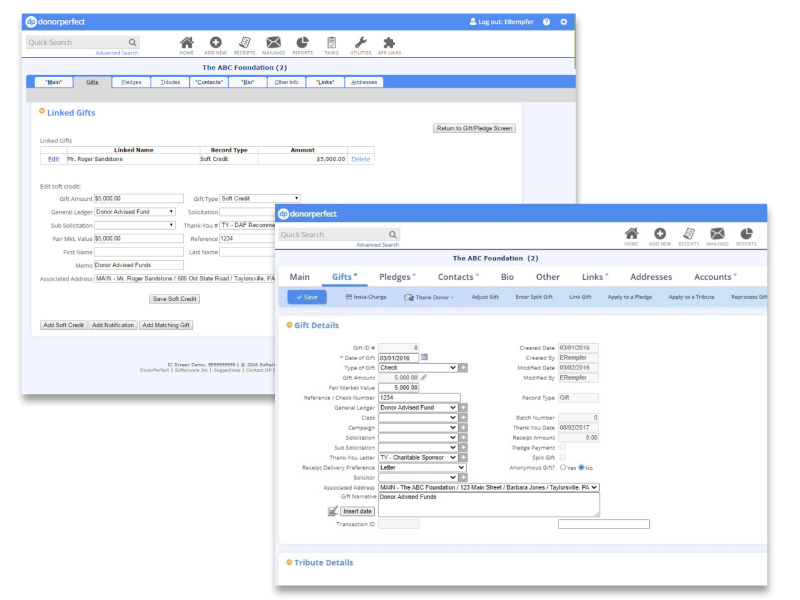

When you receive a gift from a donor-advised fund, the charitable sponsor is the official donor, so you should record the gift in a donor record for that organization (ex: Vanguard Charitable Endowment).

The gift should also then be “soft-credited” to the specific donor that recommended the grant. Typically, the owner of the donor-advised fund will be identified as the grant-maker, unless the donor has requested that the gift be made anonymously.

The same way you credit both the charitable sponsor and the donor, you’ll also want to thank both of them, even though the donor is only soft-credited in your records. Be sure to create a specific acknowledgment letter that recognizes the donor as the one who recommended your nonprofit to receive the grant.

Sending sponsors solicitations and other donor mailings is a waste of resources. For that reason, mark donor records for these organizations as “Do Not Mail.”

When these types of gifts are given from a donor-advised fund, your organization doesn’t need to have a brokerage account, manage selling the assets, or provide the necessary paperwork for recognizing the gift. Through a donor-advised fund, your organization will just receive a check for the proceeds. Simple as that!

Although the IRS prohibits the use of donor-advised funds as pledges, you can always ask a donor to commit to recommending a grant for your organization.

But that doesn’t mean you can’t give a donor event tickets to thank them for having recommended a grant.

For example, some use it as a philanthropic savings account, while others use it as an immediate gift conduit and recommend grants soon after they contribute. Some donors use their donor-advised funds to give to many different organizations, and some give to just one charity. Engaging donors in a discussion or conducting a survey about how they use their donor-advised funds can help your organization’s outreach better support those efforts.

This eliminates the need for the donor to initiate the grant each year. Asking a donor to make a recurring grant will significantly increase the likelihood of the donor’s continued support.

By setting up and funding a donor-advised fund, a donor demonstrates a great commitment to philanthropy and a demonstration of capacity. The average balance of a donor-advised fund is about $300,000. All those funds (and likely more) will eventually be given away.

When you credit a grant from a donor-advised fund to a charitable sponsor in DonorPerfect, you should also soft-credit the donor who recommended the grant. These gift records can be linked together for easy reference, tracking, and reporting.

Instantly (and effortlessly) send personalized acknowledgments using DonorPerfect. With DonorPerfect’s Thank-a-Donor feature, you can store letter templates for both charitable sponsors and donors that will auto-fill their information and acknowledge their gifts the moment a grant is received. This smart feature helps build relationships while making personalized communication simple and seamless. In addition to letters, you can use this feature to instantly send a thank you email to charitable sponsors and donors.

With these recommendations in mind, you may just be ready to begin pursuing donor-advised funds for your mission. But don’t go at it alone. Get the tools and support to bolster your team’s success from DonorPerfect.

Follow us on social!