Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

February 9, 2023 |

Donor Advised Funds (DAFs) are investment accounts, typically managed by wealth management firms or community foundations, that donors can use to take immediate advantage of charitable tax benefits while they research potential beneficiaries and allow the investment to grow. Appreciated assets in DAFs aren’t subject to capital gains tax, and savvy donors can use DAFs for their personal best interest and to support the causes they care about most.

These accounts offer benefits to nonprofits, too! Here are the top three advantages DAFs offer to nonprofits, in addition to the outright gifts.

To establish a DAF, some wealth management firms require a minimum deposit, ranging from $0 to as high as $25,000. If your nonprofit receives a gift from a DAF with a high entrance requirement, it tells you that the donor likely has a high giving capacity and should be on your radar for gifts of significance.

Even if a DAF didn’t require an establishing deposit, creating the account is enough data to prove that the prospective donor is serious about their giving. They went out of their way to create a specific account for charity, indicating that philanthropy is a priority for them. The presence of a DAF is evidence of both capacity and inclination to give, which can sometimes take multiple visits to determine, saving you and your prospective donors time and effort.

Pro tip: Make sure you’re crediting your donors correctly! With DAFs, the donor has already gotten their charitable tax incentive, so legal credit goes to the financial institution that sends the check to the nonprofit. When you know who the donor is, you can give them soft credit, which indicates that they were involved in the gift so you can keep track of stewardship and other touchpoints.

Unsure of who gave through their DAF? You might get a check from a financial institution without the donor’s name attached. In this case, reach out to the financial institution to see if you can get the donor’s name or if they can pass along a thank-you note including your contact information on your behalf. Financial institutions won’t share information the donor doesn’t authorize, so you might have to get a little creative when it comes to stewardship.

Sometimes account holders with DAFs want to be charitable, but aren’t sure of where to start, or may not have the time it takes to determine which nonprofits they want to support. They may be passionate about a particular cause, but beyond that, trust their financial or philanthropic advisors to make decisions on their behalf.

It’s worth noting that financial management institutions don’t have the final say over where gifts from DAFs are directed – they don’t want to favor particular nonprofits over others, and giving generally falls outside of their purview. However, it’s worth reaching out to organizations that manage DAFs to learn their processes.

Advisors want to give their clients the best options for making a difference with their DAFs, and getting your nonprofit’s name in front of them can mean getting exposure to multiple, high-capacity donors. If an institution offers its their clients lists of potential nonprofits to support, see how you can get your organization on those lists.

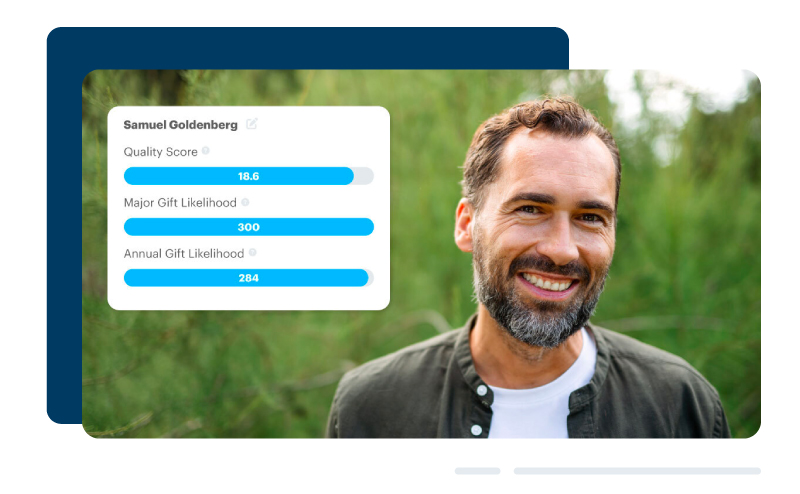

Want to find major gift prospects that are already in your database?

Check out DonorSearch today!

DAFs offer donors the chance to have a bigger impact than an outright cash gift. For example, if a donor has had good luck in the stock market, they can donate appreciated stock without paying capital gains in addition to receiving a charitable tax incentive. However, if they sell the stock and then donate the cash proceeds, they’re taxed on the sale of the stock, reducing the amount available for the nonprofit.

For many nonprofits, particularly smaller organizations, it might be challenging to accept gifts of stock if they don’t already have the infrastructure in place. Thankfully, DAF gifts are sent to nonprofits in the form of a check, making it quick and easy for organizations to accept these gifts and put them to use. And for organizations that do accept gifts of stock, many online portals charge large fees – upwards of 5% – to process them directly.

If you and your donors would like to avoid high taxes and processing fees, they can donate stock directly to their DAFs, and when they make distributions, you’ll receive them in the form of a check.

Pro tip: If your nonprofit has supporters who are interested in making gifts of stock but you’re not sure how to move forward, encourage them to set up a DAF! They’ll get the same benefits as donating stock directly, and you’ll have no trouble processing the check when it arrives.

Interested in expanding your prospect research efforts? In addition to DAFs, you can use demographic data and other financial indicators to discover promising major gift prospects that are already in your database, and create donor engagement efforts that speak directly to their hearts and minds.

Follow us on social!