Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

April 29, 2020 |

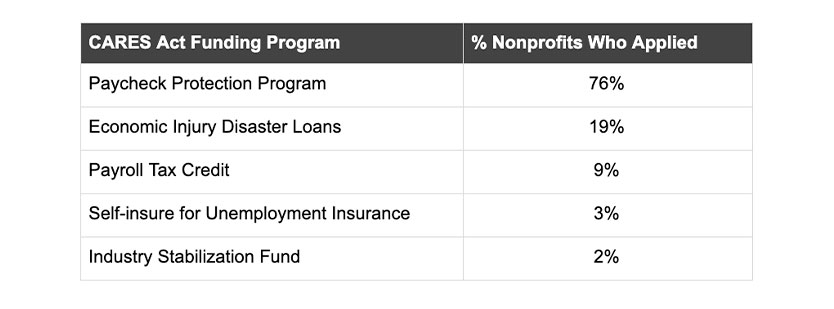

In a DonorPerfect survey of over 750 nonprofit organizations across the US, 80% have applied for at least one of the CARES act funding programs, with 24% applying for more than one. The most sought-after program was the Paycheck Protection Program.

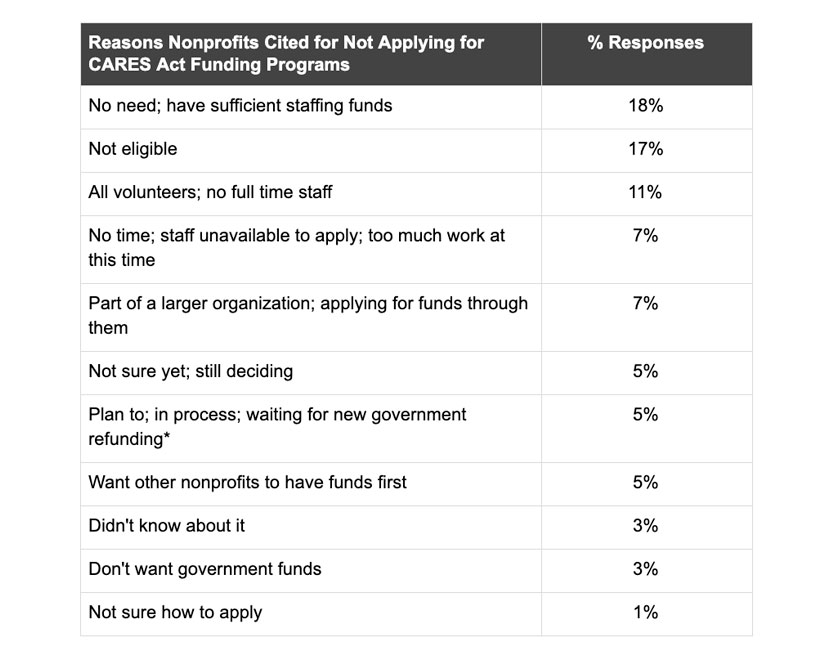

Of the 20% who did not apply for CARES Act funding, the most cited reason was sufficient funds to cover their needs, followed by those who did not think they were eligible. Many nonprofits also cited their desire for other organizations to have the funds first due to more urgent need or because they are helping those directly impacted by COVID-19.

*This survey was taken just before the second round of funding was signed into law.

In our survey, we asked nonprofits to share their advice to their peers who have yet to apply for CARES Act funding. Here’s what they had to say:

Of course, the overwhelming majority of nonprofits urge you to apply for CARES Act funding as early as you can. They also suggest having the right people on your side to help you prepare and/or submit your application, including your payroll experts, grant writers, bookkeepers, accountants, and/or your bank/lender.

Start with your bank. Many nonprofits claim that it’s best to call them, rather than research the application process yourself, based on the following:

Many respondents found that larger, national banks are depleting their funds sooner, so smaller, lesser known banks and credit unions appear to be a safer bet. Some are saying that you do not have to have an account with the lender to apply, so you may want to consider shopping around if your bank is not participating.

Some survey respondents report being asked to provide additional paperwork after initial contact with a lender or application preparer. They recommend providing as many supporting documents upfront as possible to avoid delay. This can include 941’s, 990’s, bank statements, IRS letter, 501(c)(3) letter, Secretary of State Incorporation – just to name a few.

There have been several complaints that once an application is submitted, the applicant hears nothing for what feels like forever. Many are suggesting that you make it a point to follow up with your bank/lender regularly to see that your application was submitted in a timely fashion and to receive status updates.

Keep in mind that CARES Act loan applications are for all types of small businesses, not just nonprofits, so you will come across fields requiring personal data, like a social security number. To avoid confusion about whose to use, plan ahead with your board to determine who will take ownership of this loan and use that individual’s personal information.

Unfortunately, many applicants were denied a loan and need to find other solutions to keep their nonprofit afloat. The ideas they have come up with are to:

If you are interested in applying, here are some resources & FAQs from Your Part-Time Controller that can provide assistance.

Note: We encourage you to consult your nonprofit’s advisors (e.g. accountant or attorney) for professional advice on these programs.

Follow us on social!