Webinar Tracks

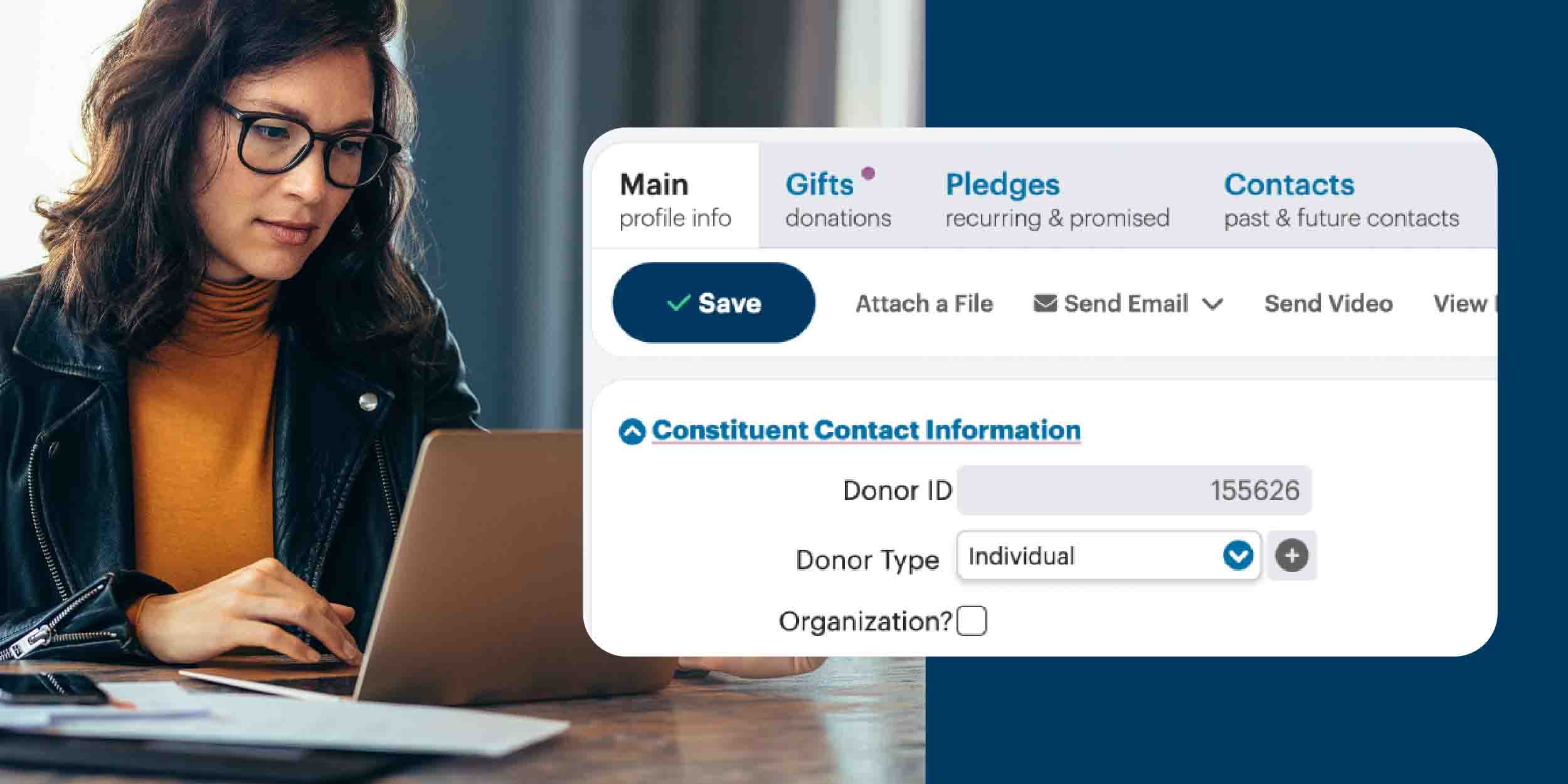

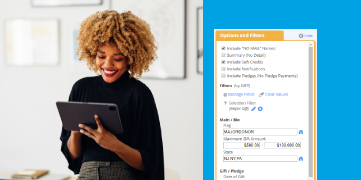

Through a series of step-by-step videos that are easy for you and your team to understand, each of our on-demand webinar tracks allow you to see, up close, what DonorPerfect can do for you. From data entry, reporting, and beyond, get the information you need when you need it.

Structure your own success

Our foundation series is designed to teach new DonorPerfect users needed skills to achieve immediate results. We will provide you with the framework to put efficient processes into place.

We recommend viewing the webinars in each series in numbered order.

Foundation Series

Monthly Giving Series

Preparing for Events

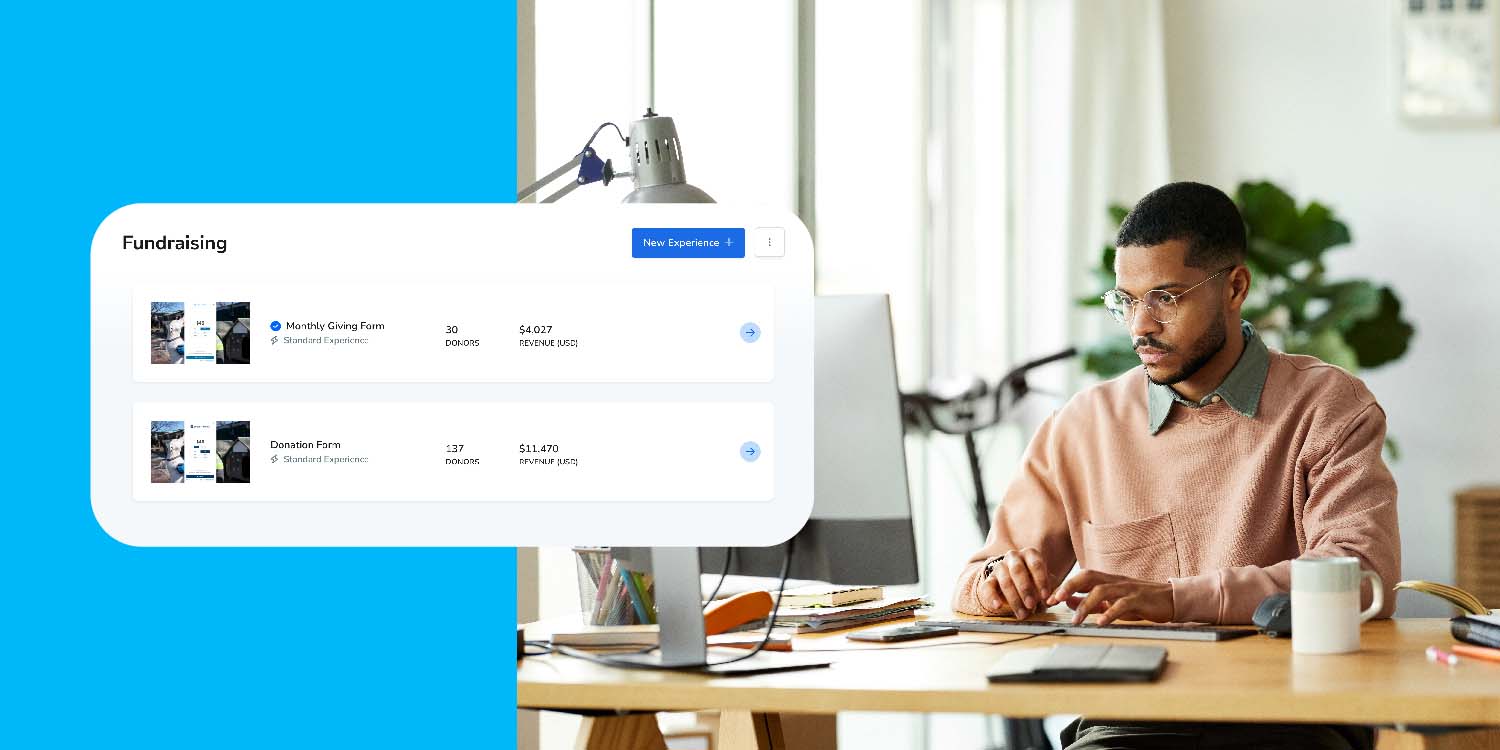

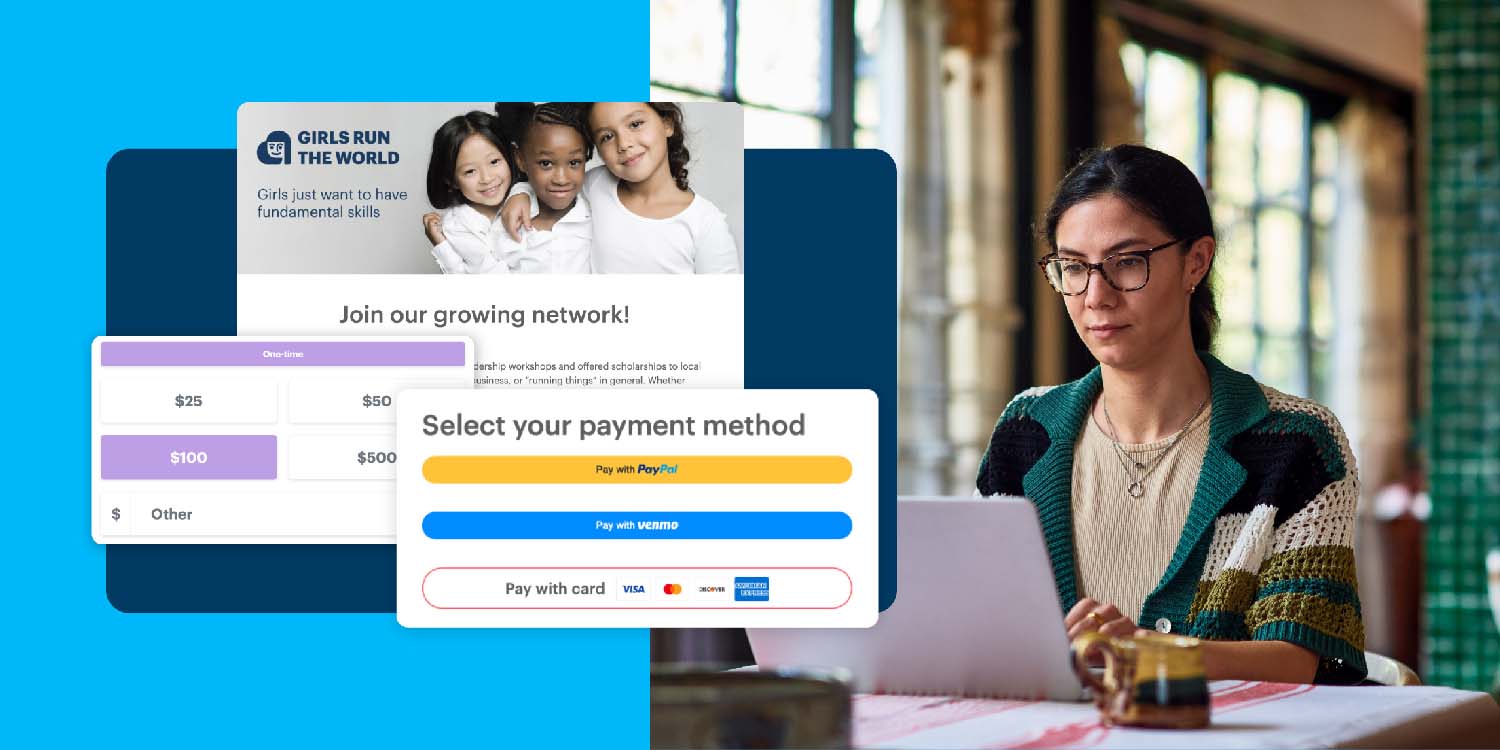

Online Giving Solutions

End of Year

Data Management

Donor Engagement

Additional Webinars

CFRE

DonorPerfect webinars and online classes are eligible for education points toward your Certified Fund Raising Executive (CFRE) International certification. Gaining credits through CFRE International shows that you are an informed fundraising professional committed to ethical practices, industry accountability, and doing good.

Track your credits