Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

September 30, 2025 | Donor Data, Fundraising Operations, Nonprofit Trends, Planning

Beginning in 2026, the One Big Beautiful Bill Act (H.R. 1) introduces sweeping changes to the tax laws surrounding charitable contributions, affecting how donors give, when, and why.

What does this mean? Skip ahead for quick answers >>

Navigating updates to charitable tax laws under the OBBBA can feel overwhelming for even the most seasoned nonprofit professional, especially at year’s end. With so many moving parts—appeals, reporting, receipting, and deadlines—new compliance rules add pressure to an already critical time.

That said, any fundraiser can turn these challenges into opportunities using a nonprofit CRM (also referred to as donor management software). This guide highlights CRM strategies to align your outreach with current tax incentives, build trust with donors, and identify strategic opportunities for your team.

Note: Donors should consult with a qualified tax advisor for personal financial decisions.

When legislation like the One Big Beautiful Bill Act reshapes what qualifies as a tax-deductible gift or changes donor behavior, a fundraiser’s ability to pivot is their superpower, and donor segmentation makes all the difference.

Tax season is about donor trust. With the new rules expanding tax incentives for some donors and reducing them for others, your messaging needs to reflect these changes in a timely, yet personal way. By using segmentation features in your nonprofit CRM, you can identify who will be affected by the new rules—and how—to tailor your appeals accordingly.

Executive Directors:

Development Directors:

Small donors now get a tax break

What changed: Starting in 2026, donors who don’t itemize their taxes can still deduct up to $1,000 (individuals) or $2,000 (joint filers) for charitable contributions.

Why it matters: Roughly 9 out of 10 taxpayers take the standard deduction. This change opens the door to a massive new audience of tax-aware donors.

Nonprofit CRM segmentation tips:

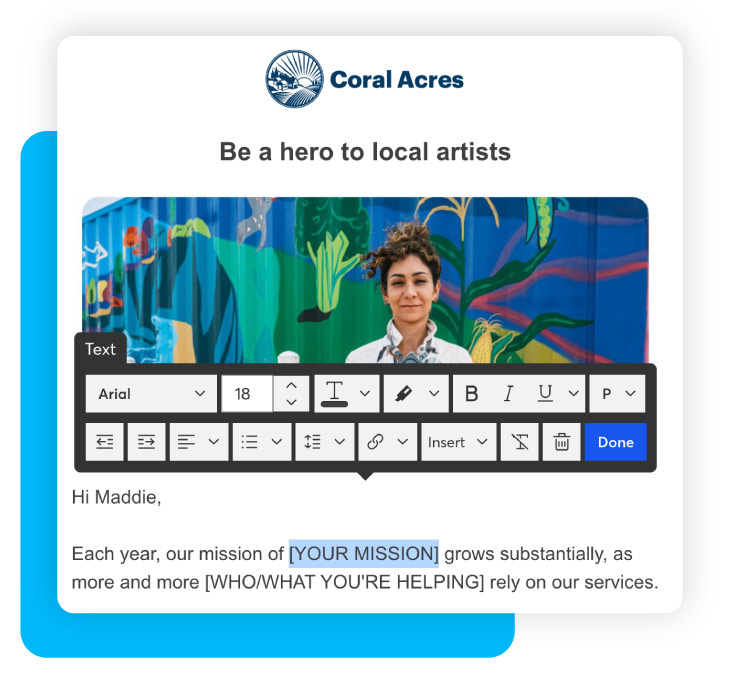

DonorPerfect tip: Using a global update, create a filter to identify your non-itemizer donors and mark their records with a flag. Using this data, you can build an email list in Constant Contact to send personalized tax messaging.

What changed: Wealthy donors no longer receive tax benefits for the first 0.5% of their giving, and their per-dollar tax savings drop slightly.

Why it matters: Major donors may begin “bunching” their charitable contributions—giving more in some years and less in others to optimize their deductions.

Nonprofit CRM segmentation tips:

DonorPerfect tip: Identify your high-value donors (using selection filters) and prospects (using the DonorSearch integration), then assign them to gift officers with a scheduled outreach cadence.

What changed: The estate tax exemption has been permanently raised to $15 million per individual.

Why it matters: Planned gifts, such as bequests and gifts from retirement accounts, are now even more tax-efficient for wealthier donors.

Nonprofit CRM segmentation tips:

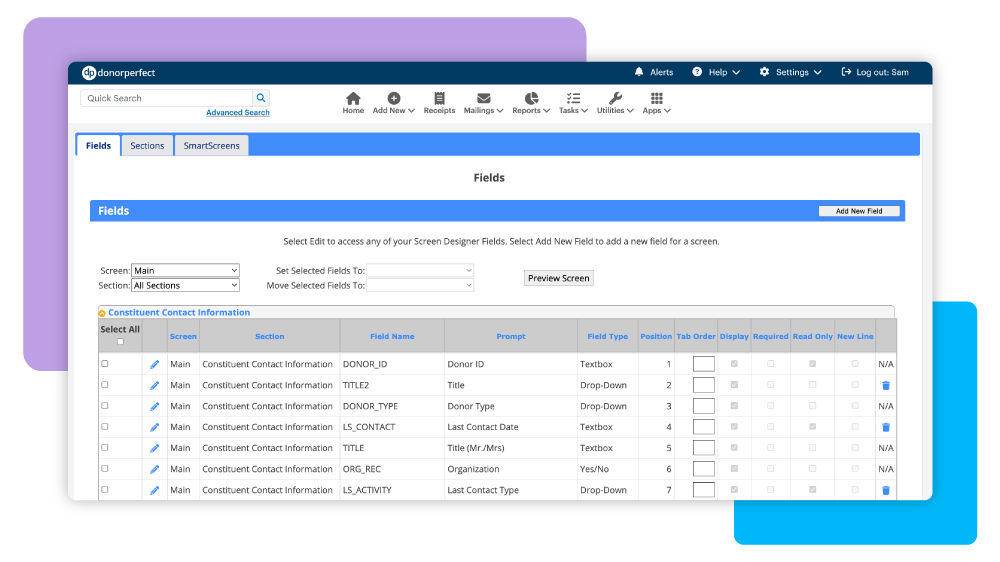

DonorPerfect tip: Use custom fields and contact management tools to track donor conversations around legacy giving and estate planning.

What changed: Corporations must now give at least 1% of taxable income for any of their charitable contributions to qualify as deductible.

Why it matters: Some companies may reduce their giving, while others could increase it to meet the minimum.

Nonprofit CRM segmentation tips:

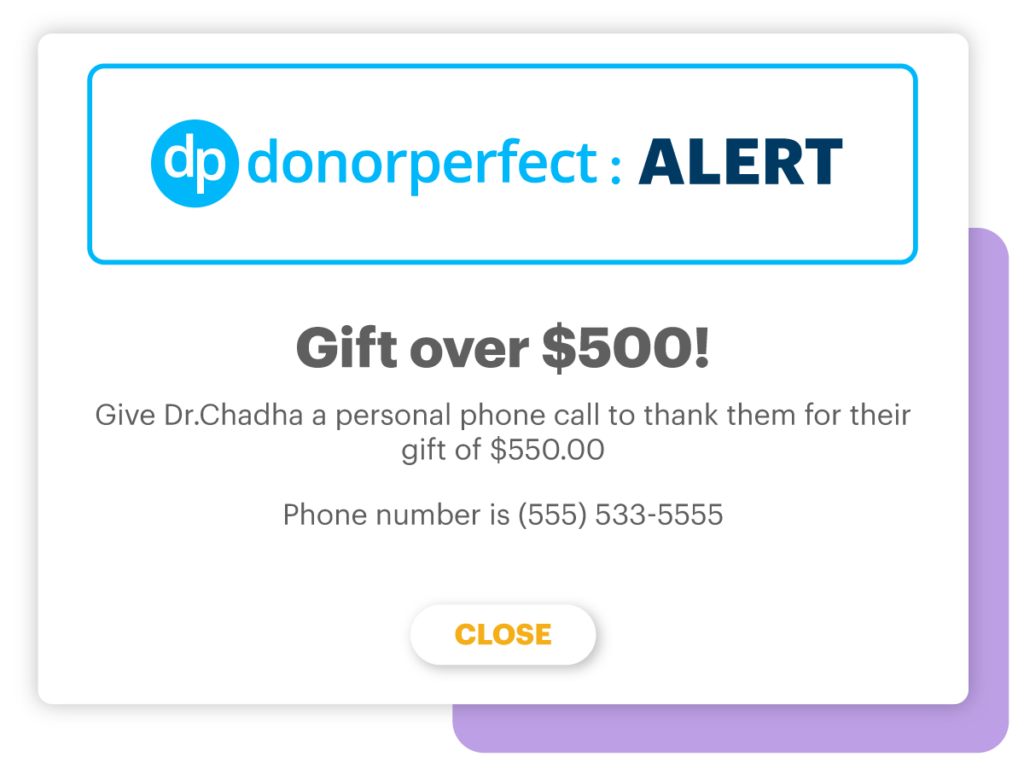

DonorPerfect tip: Track corporate gift history by: 1) creating alerts for new gifts that are a certain percentage higher or lower than the previous, and 2) setting up scheduled reports to monitor annual increases or decreases in corporate giving (based on your set threshold).

What changed: In 2027, donors may receive a $1,700 tax credit for giving to K–12 scholarship funds in states that opt into the program.

Why it matters: This is a dollar-for-dollar credit—not just a deduction—and may lead to redirected charitable contributions.

Nonprofit CRM segmentation tips:

DonorPerfect tip: Keep in touch with education donors throughout 2026 by creating dynamic email lists in Constant Contact that automatically update as their impact and eligibility change.

Turn these strategies into action with your nonprofit CRM:

In the end, tax law changes are just one factor. Donors give when they feel seen, valued, and informed. When you pair donor-centric messaging with the powerful data in your nonprofit CRM, you give every donor a reason to say “yes” to your mission, no matter what tax form they file.

Includes a complete segmentation matrix with messaging suggestions!

Follow us on social!