Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

August 27, 2024 | Donor Data, Donor Retention

You know those little pieces of paper you send out after someone makes a donation? Yep, we’re talking tax receipts. Well, they are way more exciting than they seem!

For nonprofit organizations, efficient management of tax receipts is crucial for maintaining donor relationships and ensuring financial compliance with tax regulations. As gifts are made, or as year-end approaches, many organizations find themselves overwhelmed with the task of generating and distributing accurate tax receipts to their generous supporters. Fortunately, with the right tools and strategies, this process can be streamlined and automated, saving fundraising teams time while reducing errors.

Ready to turn this tedious paperwork into a powerful fundraising tool? Let’s dive in!

Tax receipts serve as official documentation for donors to claim deductions on their tax returns. Providing accurate and timely receipts not only helps your donors, but also demonstrates your organization’s ability to be professional and accountable.

Tax receipts boost your transparency, keep you on the right side of the law, and even make your donors appreciate you more! Generating tax receipts for donors – whether in digital or print form – is crucial for nonprofits for several reasons:

In today’s digital age, nonprofits can leverage technology like constituent relationship management systems (often called nonprofit CRMs) to automate their gift confirmation and tax receipt management, saving time and reducing errors. We recommend that organizations, small and large, implement a thorough process:

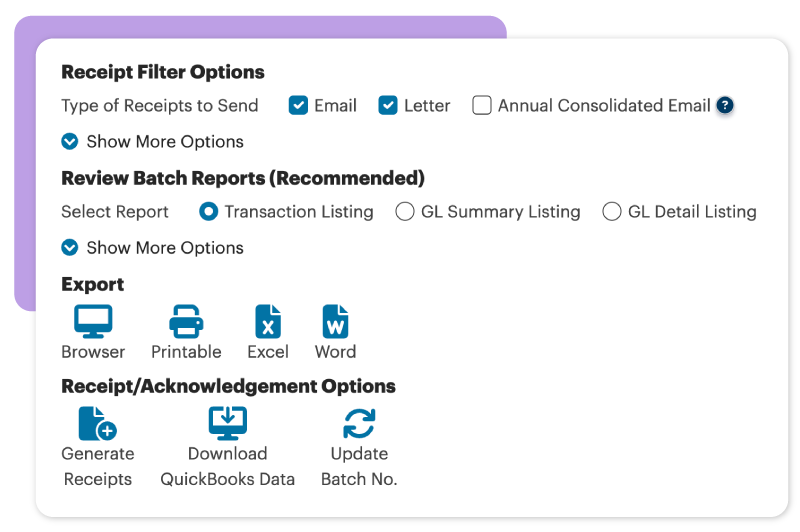

To meet different nonprofit needs, DonorPerfect has two ways to send receipts: 1) from the donor record, immediately after entering an individual gift, or 2) from the Receipts module, which allows you to send thousands of receipts at once. You can also quickly and easily set up alerts for pending email receipts and thank you letters.

Donors contribute to nonprofits in various ways (e.g., cash, check, stock, online, in-kind gifts, etc.), and your organization should set up receipt options based on your gift acceptance policies. How donors make their gift and the frequency of their giving are also factors to consider. For example:

With DonorPerfect, you can turn on Automatic Receipts for Monthly Giving to have receipts instantly emailed to monthly donors after each successful batch. You’ll save time and boost donor retention!

As the year draws to a close, it’s crucial for nonprofits to prepare and distribute end-of-year giving statements for their donors. These statements not only serve as a summary of contributions, but also play a key role in helping donors with their tax preparations. Check out this end-of-year sample tax letter and video below.

Correctly generating and automating tax receipts is essential for maintaining donor trust and organizational efficiency. From donation processing to email integration, leverage features to ensure timely, accurate, and compliant tax receipts, while freeing up valuable time and resources to focus on your mission.

DonorPerfect offers a variety of CRM automation features to simplify your donation and donor management processes. Learn more about DonorPerfect’s SmartActions, today!

1. Should my nonprofit organization send a tax receipt and a thank you note separately?

2. What should my organization include in gift acknowledgement letters?

3. Can I increase donor engagement with a receipt form?

Follow us on social!