Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

November 20, 2023 | Donor Data, Year End

Nonprofit employees work hard! Fundraising is often a tiring and cyclical process. Simple appeal letters require a great deal of time, energy, and resources to engage your following of supporters. The last thing you want is for your data to be hindering your efforts. Your donor data should be one of your greatest assets, ensuring you have the accurate details you need to best serve your cause. So where might your data be steering you off course? Here is a list of 10 common nonprofit data maintenance mistakes that can be ruining your chances of securing your next donation.

When it comes to style, everyone has their own. That’s a great thing, but not when it comes to donor data management. Make sure your team is following a style guide so all data being input by any user is entered using the same rules. This will help you avoid having to clean up a mail merge file at the last minute before sending it to the printer or the mail house. Even more important, it will prevent any lost funds from undeliverable mailings.

When it comes to nonprofit data cleanup, think small, as in the devil is in the details. Do you use ampersands or the word “and”? How about abbreviations? Outline all of the inconsistencies in your data, sit down with your team, and make the decisions you need to get everyone on the same page.

Don’t know where to start? DonorPerfect’s Clean Data Checklist can help.

After crafting the perfect appeal, there’s nothing that’s going to undermine your efforts more than a donor base full of missing emails and mailing addresses. Whenever and wherever you get the opportunity, collect this information from your donors. Include a place on your website to sign up for mailings. Ask for email addresses on your donation forms. You could even include a space for emails on your mail-in remittance slips.

If you have partial mailing addresses for your donors, take some time to gather the missing data. You can do a quick Google or whitepage search to find complete addresses.

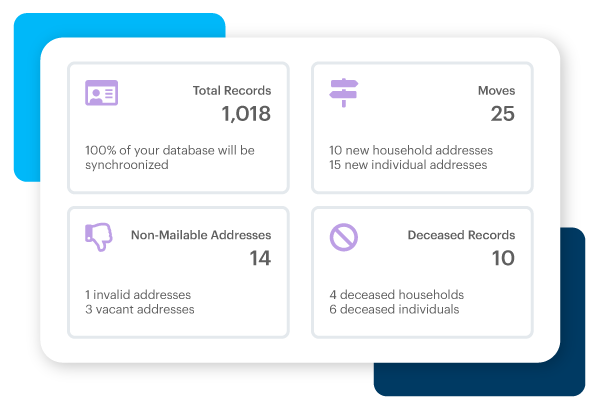

Consider last-minute scrambling before your major appeals a thing of the past. If you’re really in need of some mailing address cleanup, consider a service like DP Address Updater to keep your donor information in tip-top shape.

Keeping your salutations in good order is so important. For example, before you send out a big mailing, think about how much time you spend correcting how people are addressed. One user may enter nicknames into your database, while another uses full names, or a title and last name. A best practice is to create multiple fields for each way you want to address a constituent and be consistent with how you use these fields. This will save you the wasted resources used to correct those mistakes before it comes time to send out a major appeal.

Remember to keep donor records as up-to-date as possible, as well. If someone from your team has a conversation with a recently divorced or widowed donor, make sure this status is reflected in their donor record. This is especially paramount if you’ve received tribute donations in memory of their loved ones. Fundraising is all about relationships, so make sure you are doing your part to create a healthy and thriving one.

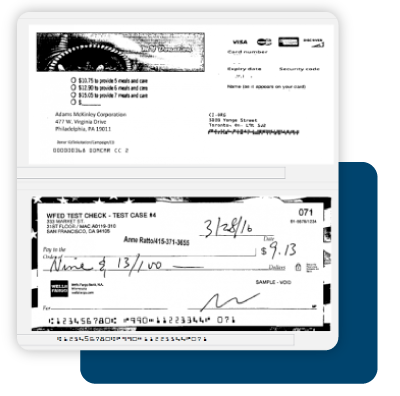

Your donors want to hear from you after sending a gift. Remember the golden rule, a donor thanked within 48 hours of making a donation is significantly more likely to give again. That means checks, remittance slips, and all other donations need to be entered into your database quickly. This will allow you to generate your thank-you letters and emails efficiently and record that they have been acknowledged so you can rest easy.

Thanking donors is key in donor retention and will save you countless dollars on acquisition. Make sure you are communicating with your supporters in a timely manner to generate a donor base that you can come back to for future appeals.

Have a lot of checks to process? Consider a tool like DPCheck Scan to quickly, easily, and accurately process check donations and have them entered into your database.

A more recent and highly effective fundraising strategy is donor segmentation. Sending out personalized communications to targeted donor segments will help you generate more fundraising dollars. There are a ton of ways to create these targeted groups, but you won’t be able to if you’re not tracking the details about your donors.

One method of grouping donors and writing targeted messages is by tracking what has resonated with them in the past. If they’ve given through a specific appeal or directed their funding to a program, track this information on their gift record in fields like general ledger and solicitation. Having this data can help inform your fundraising strategy in future endeavors.

While we’re on the topic of gift codes, having a messy coding system makes running meaningful reports a huge challenge. How do you know how your fundraising campaigns are performing without accurate data?

For example, if one person tracks an effort as a general ledger and another user tracks the same effort as a campaign, when it comes time to pull a report you may very well have relevant gifts missing from your data.

If your data is not accurate, it may misinform your future campaigns to the detriment of your fundraising efforts. On the other hand, an accurate report on campaign performance will help build your future strategies, hopefully guaranteeing you even more success.

Along with tracking the appeals your donors have responded to, it can be helpful to track how you communicated the appeal as this may indicate their preferred contact method in the future.

Oftentimes assumptions are made based on generational differences. Many think that younger donors prefer digital appeals, but there is growing evidence that shows millennials respond quite well to direct mail. Rather than targeting a group based on their age, it’s best to track what they have responded to in the past so you can continue to communicate in meaningful ways with them.

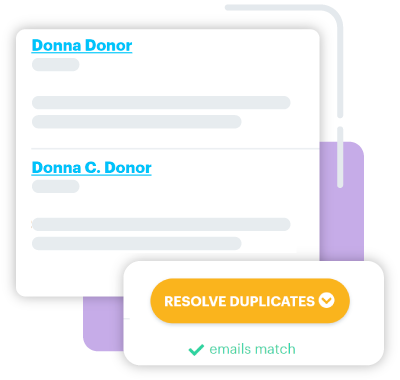

Having a system full of duplicate donor records may be undermining your fundraising efforts more than you realize. Having a duplicate record may seem innocent enough, but there are so many ways in which it can negatively impact your work:

You will miss potential major donors whose giving total has been split among multiple records.

Duplicate donor records shouldn’t ruin your efforts. Carve out some time monthly or quarterly (or before any major appeal) to manage your records. If you have a system like DonorPerfect, the duplicate maintenance module cleans them up quickly.

Monthly givers are one of the best assets a nonprofit organization can have. They support you loyally month after month so you can continue your mission with less fundraising legwork. Not maintaining your data related to monthly giving can wreak havoc on such important revenue. Even if you faithfully process your monthly gifts by generating invoices and charging credit cards, you may still be missing credit cards that are expiring. Make sure to run regular reports to monitor which donors have payment methods that will be expiring shortly and follow up with them beforehand.

DonorPerfect’s monthly giving module takes the work out of recurring gifts. Monthly gifts are processed automatically, and the module has an credit card updater that runs every night to audit card payment information. It will automatically update expiring credit cards, ensuring you never miss a monthly gift again.

Keeping accurate records of donors and their gifts is paramount to your success, but it’s also important to keep track of the relationships you are building with your constituents. This means you should record event attendance, volunteer hours, phone calls, meetings, and any other interactions that occur between you and your donors. Keep track of the small details that will lend insight into their motivations. This could be the difference between securing a new major donor or legacy gift instead of an increased attrition rate.

Data maintenance is important year-round, but when the chaos of Giving Tuesday and year-end fundraising comes, you need to prioritize it more than ever. Make sure your year-end efforts are not hindered by messy data. For more help with keeping your data clean to make the most of your fundraising efforts download DonorPerfect’s Clean Data Checklist.

Follow us on social!