Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

December 2, 2025 | Donor Engagement, Fundraising Communication, Fundraising Operations

The One Big Beautiful Bill Act (OBBBA) introduces some of the most significant updates to charitable tax incentives in years. For development professionals, nonprofit executives, and founders, understanding how these changes impact donor-advised funds (DAFs) and charitable contributions is crucial to helping donors navigate their philanthropic plans confidently and effectively.

You may have already heard: “DAF gifts won’t be deductible anymore.”

That’s not quite right. But it’s not totally wrong either.

In this blog, we’ll break down what the new legislation means, what donors will experience, and how your nonprofit can adapt its fundraising strategy for 2026.

Beginning January 1, 2026, DAF contributions will still be tax-deductible, but with new limitations:

Note: This blog is intended for general informational purposes only. Because policies can change, and because every donor’s financial situation is unique, encourage your supporters to consult their tax advisor to understand how these changes may affect their charitable contributions.

Pro tip: Donor conversations are more productive when you know who you’re talking to—and what matters to them.

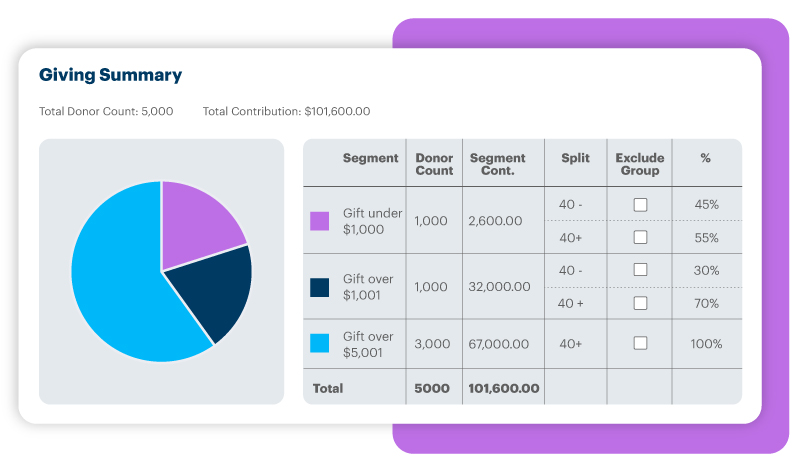

Target your outreach with precision. Use DonorPerfect’s custom fields and filters to segment donors by giving method and indicators like DAF giving history or gift size. This can help your team tailor messaging based on each donor’s likely tax profile and philanthropic behavior.

To help visualize the impact, here’s a side-by-side comparison of key provisions under current and future law:

| Provision | Pre-2026 (Current Law) | 2026+ (OBBBA Rules) |

| Deduction for DAF contributions | Yes, if itemizing | Yes, if itemizing – subject to 0.5% AGI floor |

| Above-the-line deduction (non-itemizers) | None | $1,000 / $2,000 (DAFs excluded) |

| Limit on total deduction | 60% of AGI (cash gifts) | Same, but with 0.5% floor |

| Max tax benefit (for top-bracket donors) | Full marginal rate (up to 37%) | Capped at 35% |

| Effective date | Current – through December 31, 2025 | January 1, 2026 |

Note: In general, gifts below the new 0.5% AGI floor are not deductible; Amounts limited by the existing AGI percentage caps can still be carried forward, but amounts disallowed because of the new 0.5% AGI floor cannot be carried forward.

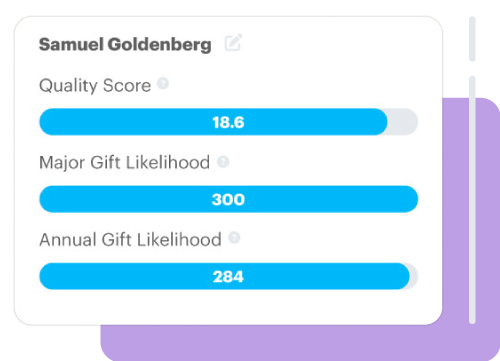

Pro tip: Not all donors will be equally affected by the 2026 rule changes, and not all will need the same message.

Prioritize your highest-impact conversations. With DonorPerfect integrations like DonorSearch, you can identify wealth indicators and philanthropic trends that help you focus on the donors most likely to give—and most likely to need guidance.

The examples below illustrate how the OBBBA may affect charitable contributions and deduction value for donors across income levels. At higher income brackets, the tax benefit of deductions drops by approximately 7–10% due to the new AGI floor and 35% benefit cap—making timing and strategy especially important.

| Donor | AGI | Gift | 2025 Rules | 2026 Rules | Change |

| Middle-income, non-itemizer | $75K | $2K | No deduction | $2K above-the-line (direct only) | DAF loses benefit |

| Itemizing couple | $250K | $10K | Full deduction | Only contributions above the 0.5% AGI floor are deductible. | -13% benefit |

| High-income donor | $1M | $200K | Deduction worth up to 37% | 35% cap + $5K floor | -8% benefit |

| Mega donor | $2M | $500K | Deduction worth up to 37% | 35% cap + $10K floor | -7% benefit |

Interpreting the data:

Donor-advised funds remain a viable tool for strategic giving—especially for itemizers—but with reduced tax leverage under the new rules. Direct charitable contributions now offer greater efficiency for many donors, particularly non-itemizers.

Whether your supporters give through donor-advised funds or direct gifts, timing, segmentation, and clear messaging will be critical to sustaining support in 2026 and beyond.

As news about tax law changes circulates, your donors may come to you with questions—or misconceptions. This is your opportunity to offer reassurance, reinforce your expertise, and strengthen donor trust.

When a donor says, “I heard DAF gifts won’t be deductible anymore,” don’t rush to correct them. Instead, acknowledge the confusion and calmly clarify:

“That’s a common misunderstanding. Donor-advised fund contributions will still be deductible for itemizers—but starting in 2026, there will be a small floor and a cap on the benefit.”

With the right framing, DAFs remain a compelling option, even with reduced tax leverage. Emphasize benefits such as their ability to:

Position your team as a resource—not just for answering questions, but for helping donors give with intention and strategy.

Pro tip: The best time to engage donors about their giving strategy is before they bring it up.

Streamline donor engagement. Use DonorPerfect’s donor journey mapping tools to track and respond to major giving signals—like DAF contributions—with timely, personalized outreach that keeps donors connected and inspired to give.

Use 2025 as a runway:

Reintroduce the value of direct giving:

A proactive plan can make all the difference in how your supporters respond to the 2026 changes. Here’s how to get ahead:

Donor segmentation is key to making your message stick. Check out our blog: 5 Donor Segmentation Strategies to Increase Charitable Contributions Under the One Big Beautiful Bill Act.

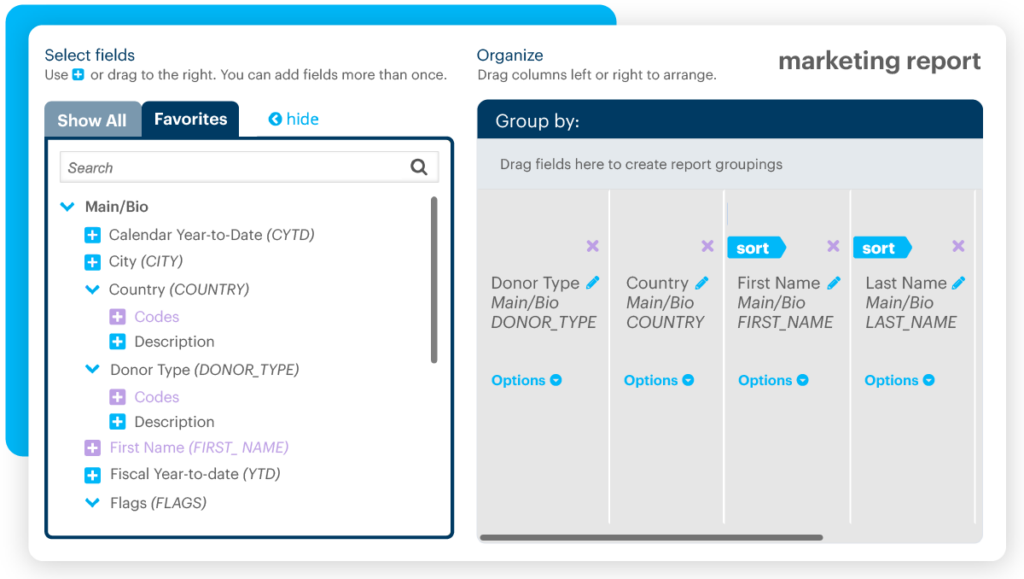

Pro tip: Data clarity helps you respond faster and act smarter, especially during tax season.

Surface the right donors at the right time. Build custom reports in DonorPerfect to flag itemizing donors impacted by the new AGI floor, and automate alerts so your team can reach out well before year-end.

When meeting with a donor-advised fund supporter, try framing the discussion like this:

“You may have heard that donor-advised fund deductions are going away—but they’re not. Starting in 2026, there will be a small AGI floor and a cap on how much tax benefit you can claim. For non-itemizers, a new small deduction applies, but only to direct gifts.

For major donors like you, DAFs still make sense—they just deliver slightly less of a tax offset. The real advantage remains the same: flexibility, control, and long-term giving power.”

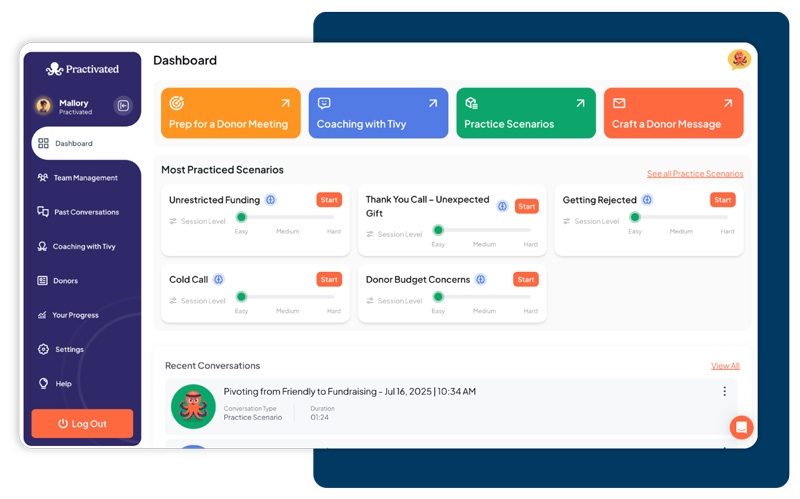

Pro tip: Knowing what to say is just as important as knowing who to say it to.

Build donor confidence before the conversation. Through DonorPerfect’s integration with Practivated™, your team can sharpen their asks, refine their messaging, and role-play high-stakes donor meetings in a private, AI-powered environment, so every conversation feels intentional and not improvised.

The role of DAFs is evolving, and your response should, too.

The OBBBA doesn’t eliminate donor-advised funds—it recalibrates the incentives behind them. For nonprofits, this shift is not only a compliance challenge but a chance to lead with clarity, strengthen donor relationships, and reinforce your value as a trusted partner in philanthropy.

Pro tip: Tax law changes don’t just impact your donors. They reshape how your team should fundraise.

Lead with strategy, not stress. Download Navigating Charitable Tax Changes Using Your Nonprofit CRM to learn how your team can adapt with confidence, strengthen major donor relationships, and inspire gifts across all giving levels using the tools already built into DonorPerfect.

With thoughtful communication and the right tools, your team can confidently guide supporters through these changes—ensuring they continue to give generously, strategically, and with purpose.

Are you looking to adapt your fundraising strategy with confidence? Now’s the time to refresh your understanding of charitable contributions and tax changes and equip your team with the right fundraising tools to make it possible.

1. Will donors still get a tax deduction if they use a DAF?

2. What if a donor doesn’t itemize?

3. Should we be steering donors away from donor-advised funds?

4. How do we know which donors are most affected?

Support your team’s fundraising strategy

Follow us on social!