Nonprofit Technology & Fundraising Blog

Subscribe to our mailing list

September 25, 2025 | Donor Engagement, Fundraising Operations, Major Donors

For decades, major gift fundraising has focused on large cash contributions from major donors. But today’s philanthropists are increasingly diverse in both their assets and their giving preferences. From stocks and donor-advised funds (DAFs) to real estate and cryptocurrency, opportunities abound, expanding what counts as a major gift.

Forward-thinking nonprofits are reimagining how they use their nonprofit CRM and fundraising tools to engage their most generous supporters, broadening giving options to grow pipelines, strengthen relationships, and build sustainable revenue streams.

In this blog, we’ll explore why it’s time to shift perspective, the most common non-cash giving methods, how to prepare your organization, and how to educate and invite major donors into new ways of giving.

Philanthropy is evolving. Today’s high-net-worth individuals and families hold wealth in a range of assets beyond cash. The majority of wealth in the U.S. is concentrated in non-cash assets such as securities, real estate, and business ownership.

For nonprofits, clinging to a cash-only definition of major gifts risks leaving significant generosity untapped. By embracing non-cash contributions, your organization can:

Pro tip: Rethinking major gift fundraising is about expanding the menu of opportunities. Donors who see more options are more likely to see themselves in your mission.

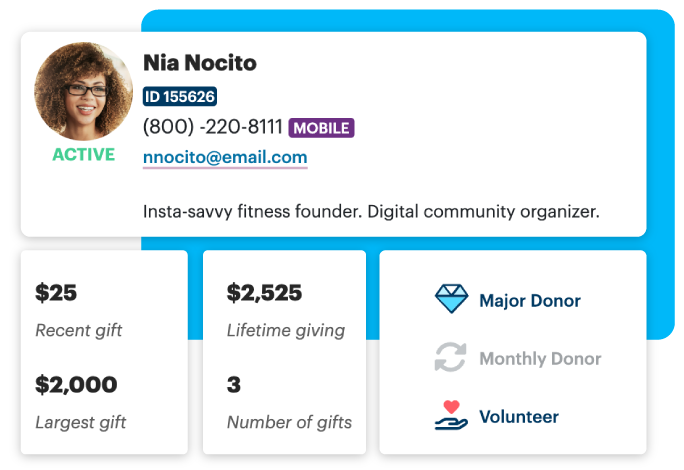

For example, with DonorPerfect’s donor management system, you can track donor interests and giving capacity beyond traditional contributions, ensuring you spot opportunities for asset-based gifts.

Now that we’ve covered why non-cash gifts matter, let’s explore the types of assets your organization can accept.

While every nonprofit doesn’t need to accept every type of non-cash gift, having a clear understanding of the most common categories and methods will help you recognize opportunities and speak confidently with major donors.

These are among the easiest and most common non-cash gifts to process.

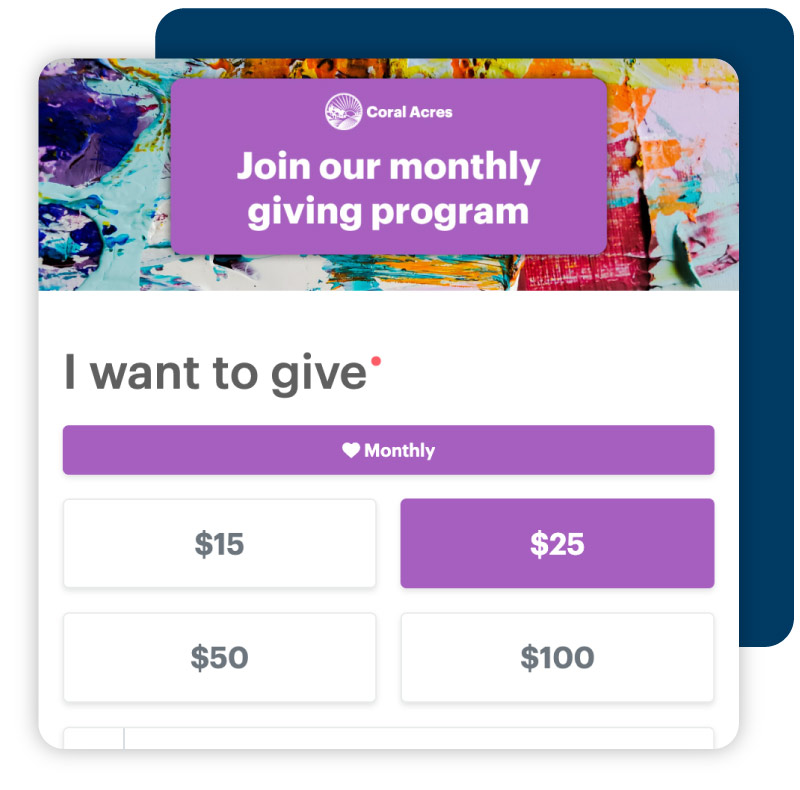

Pro tip: Make crypto giving easy for donors. Younger philanthropists expect flexibility in how they give. For example, DonorPerfect Donation Forms allow nonprofits to accept cryptocurrency through PayPal along with Venmo, Apple Pay, Google Pay, and more—all while keeping donor records accurate and secure.

You can sell or convert these tangible assets to support your mission. They often carry emotional value for donors as well as financial benefit.

These giving methods allow major donors to integrate philanthropy into their long-term financial planning.

Planned gifts ensure your nonprofit becomes part of a donor’s lasting legacy. These gifts are often realized through estate plans and can provide significant support.

Example in action: House of Ruth used wealth screening to uncover previously overlooked donors with the capacity for planned gifts. By identifying its top 100 prospects and engaging them through structured cultivation plans, the organization expanded its Legacy Circle, built stronger relationships, and grew its major gift pipeline for future bequests and commitments.

Pro tip: Pay attention to how your donors talk about their assets. If they mention investments, real estate holdings, or entrepreneurial ventures, you may have an opening for a non-cash giving conversation.

Don’t forget to track those details in your nonprofit CRM! With custom fields and reporting, you can segment donors by indicators like wealth screening details, business ownership, or investment activity.

Expanding giving options for major donors requires planning and infrastructure. Focus on these core priorities to ensure your nonprofit is ready for non-cash gifts.

Educate your leadership, development team, and board on the basics of non-cash giving. Partner with legal and financial advisors to ensure compliance and confidence. When your entire team understands the essentials, they can approach major donors with clarity and consistency.

Create a gift acceptance policy that covers what types of non-cash gifts your organization can accept, under what conditions, and how they’ll be managed. Well-defined policies protect your nonprofit, reassure donors, and give staff the confidence to respond quickly when opportunities arise.

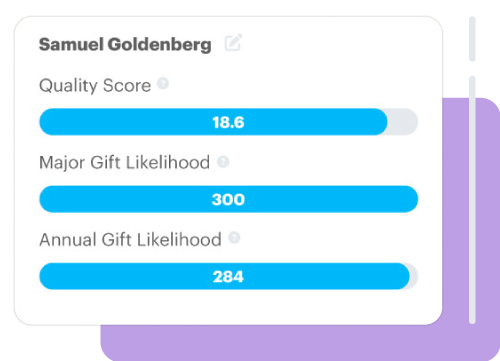

Pro tip: Build your major gift pipeline with confidence and accuracy. Don’t guess where your next major donor will come from. With DonorPerfect and DonorSearch, you can uncover giving potential in your system and steward those donors with ease. Download Your Guide to Major Gift Fundraising to get practical strategies and tools you can use right away.

Forge relationships with financial advisors, real estate professionals, and legal experts who can help plan for and process complex gifts. These trusted partners can guide both your nonprofit and your major donors, making complex contributions smoother and less intimidating.

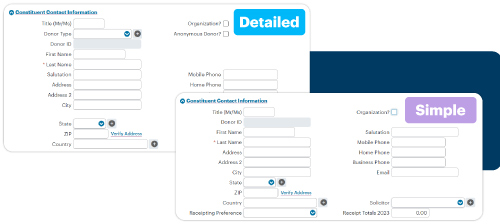

Ensure your donor management system can track these gifts, flag opportunities, and integrate them into major gift reporting and forecasting. With the right nonprofit CRM tools, your team gains visibility into donor interests and can steward non-cash gifts as effectively as traditional cash contributions.

Pro tip: Donors want to know you’re ready. Having clear policies, trusted advisors, and strong back-office systems instills confidence that their non-cash gift will be handled with care.

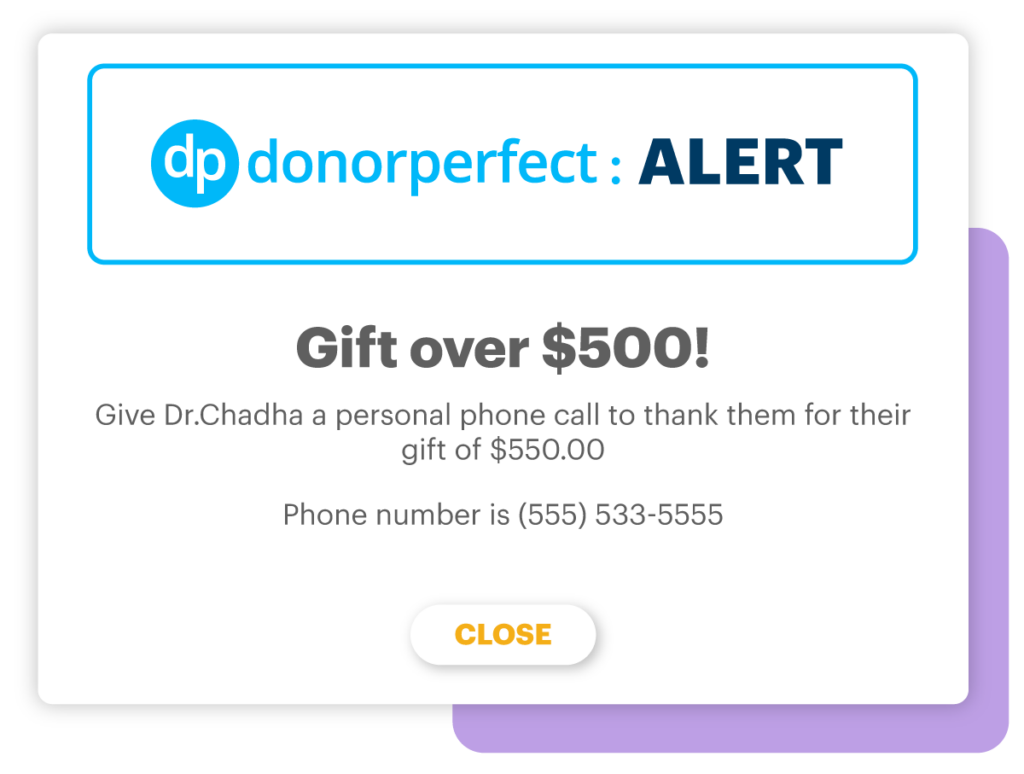

For example, DonorPerfect SmartActions can automatically flag high-capacity donors or trigger alerts when certain data points—like giving thresholds or custom fields for assets—are updated, helping your team respond with personalized outreach.

Even the most sophisticated donors may not realize how flexible and creative their philanthropy can be. Education is key to helping donors see the full range of ways they can give.

Instead of focusing solely on annual contributions, ask broader questions:

Use these questions as part of an ongoing donor journey process, and not all at once. Start with what kind of gift feels most meaningful to uncover personal values. As the relationship grows, ask what impact they want their giving to have. Together, these questions move from personal meaning to mission impact while keeping the conversation authentic.

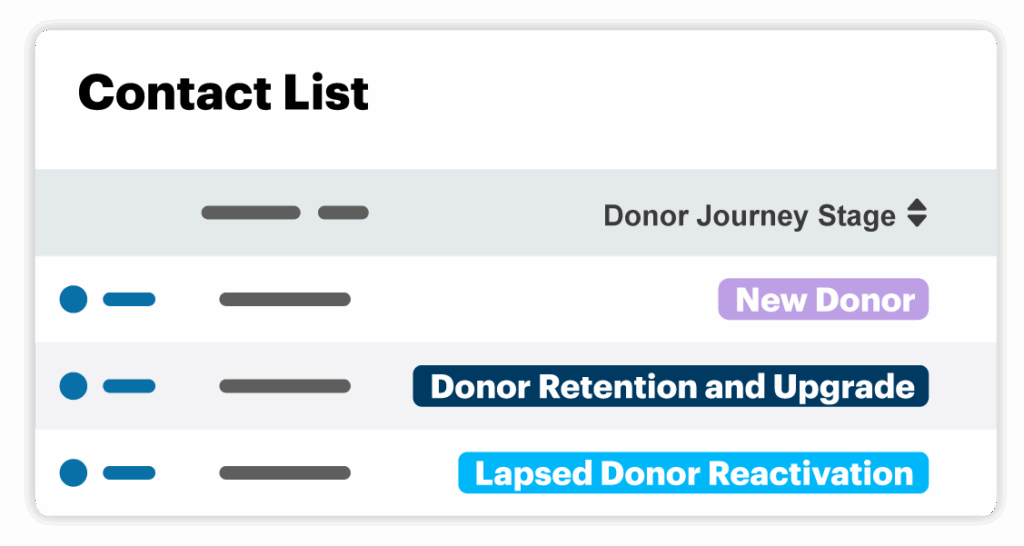

Pro tip: Every major donor is on a journey—from first learning about your mission to deciding how they want to make their most meaningful gift. With DonorPerfect, you can track every stage of that journey, set reminders for personalized outreach, and ensure no opportunity for deeper engagement falls through the cracks.

Learn more here: How to Build a Major Donor Journey.

Highlight how non-cash major giving can:

Develop educational materials—guides, FAQs, and donor stories—that show what’s possible. Clear examples make complex major giving methods approachable for donors and advisors alike.

Begin with conversations about the most common methods, like stock and DAFs. Expand into more complex options as your organization gains experience. Introducing one or two options at a time helps build confidence for both staff and supporters.

Pro tip: Major donors often rely on trusted advisors for financial decisions. Position your nonprofit as a collaborative partner, not just a beneficiary, by offering to work with their advisors directly.

With DonorPerfect, you can use prospect research tools and reporting to identify donors with high giving capacity, understand their interests, and share data-driven insights that support meaningful conversations about asset-based gifts.

Expanding major gift opportunities beyond cash is a fundraising tactic, but also a mindset shift for nonprofit leaders. By embracing asset-based giving, preparing your organization, and educating major donors, you can unlock new pathways to generosity and build long-term sustainability in creative ways. The right major donors are already in your community. They just need the right invitation. Your next major gift may not come in cash, but in assets that reflect a donor’s true capacity to give. And with DonorPerfect, you can manage every type of contribution, uncover new opportunities through prospect research, and steward your most generous supporters with confidence. Explore how our nonprofit CRM can help you grow major giving and strengthen donor relationships.

1. What is considered a non-cash major gift?

2. Why should nonprofits pursue non-cash gifts?

3. Do we need special policies to accept non-cash gifts?

4. How do we know which donors to approach?

5. Are non-cash major gifts complicated to manage?

Use data and automation to build a sustainable major donor pipeline

Follow us on social!